Google Shopping for Shopify:

The Definitive Guide

by Joshua Uebergang of Digital Darts

by Joshua Uebergang of Digital Darts

Half the money I spend on advertising is wasted; the trouble is, I don’t know which half.

John Wanamaker, an 18th century Philadelphia businessman who used novelty in advertising to promote his department stores

Your Google Shopping campaign is running. If products were recently approved in Merchant Center, it can take one week for impressions to run at their current potential because Google holds back new product ads as a precaution for user experience.

Now that the ads are running, what you decide to work on can make the campaigns more or less profitable. Effective ongoing advertising is not set-and-forget—especially for an online store that needs to make every dollar count in a rapidly changing digital environment. One new competitor can affect your average cost per click, number of clicks, and revenue. Products previously approved can get disapproved. Ads trigger for irrelevant keywords no matter how well a campaign is set up. A savvy advertiser regularly manages his campaigns and product feed. He has his finger on the pulse of his campaigns. He knows how well they are doing in a given week.

The time required to manage Google Shopping campaigns is less than search. Good skills to manage search ads like writing benefit-laden ad copy, building keyword themes in ad groups, and using as many ad extensions as possible, are redundant optimisation skills for shopping ads. You don’t write ad copy, you don’t build keyword themes in ad groups, and you don’t use search ad extensions.

If you want your shopping campaigns to get more sales while reducing wasted ad spend, I will teach you the Google Ads optimization methods we use at Digital Darts. These methods are used to launch stores as well as grow those who already do eight figures in sales per year. The beautiful thing about Google Ads is you have minute control to act on what gets sales and what does not.

Two factors—quality score and bidding—are the levers you use to grow ad revenue in Google Shopping. The levers have been repeated throughout the Shopify book. It’s time to dig into each to see how they influence campaign performance.

The quality score is pivotal to Google’s decision of where your products rank. For most of the book I’ve referred to quality score for shopping campaigns as “feed quality”. When a search query triggers a product, the highest bid does not automatically win. Google wants ads that are relevant, useful, and safe for the user. It does this by calculating a quality score. Stores with a high bid, but a low quality score may not win the auction. How your products rank is a combination of quality and bid.

The quality score for shopping ads is vaguer than search ads. Google has kept the formula of quality score for shopping ads a secret, often referring to it in their support documentation as “product history” or “feed quality”. One possible reason is to counter their own competitors like Bing from duplicating their advertising system. The more likely reason it seems is to protect their system from marketers in the same way their algorithms for organic search are blurred. However, like SEO best practices, Google educates its users so we can improve a store’s presence on the channel. It boils down to how you can better serve the person Googling.

The most important factor of quality score can be answered with this question: “Do we have a product that answers this search query?” It is an offshoot to my question, “If someone was to discover only this page on the Internet then walk away happy, what would they look for?” to come up with the perfect title and meta description for SEO. If you sell athletic strapping tape, you cannot expect to get a high quality score for general searches like “adhesive tape” where the user may want tape for crafts, school, or electrical repairs.

The best way to solve this problem is to look at high impression searches in your search terms report then see the gaps in your product range. Can you provide a product that better fits a high-impression search query? Few businesses will use this data to revisit their product range.

There are more instant ways and best practices to improve your quality score. Review all attributes of your feed to see how they can be improved. The most influential include title, description, product category, unique product identifiers, and images. These were covered in the chapter on Google Shopping feed optimization.

One last comment on the quality is to not change the id of a product approved in Merchant Center that has a good click-through rate. The id contains the quality score history. If a product had a great CTR but then you amend the product’s id, all information that helped your quality score will reset. Conversely, if you had a terrible CTR and you’ve optimised everything else, a new product ID could be a fresh start. However, Google advise against changing the ID for any reason:

Once you’ve assigned an ID to a product, don’t change it. The ID you choose, in combination with country of sale and language, identifies the product, helps us to retrieve any product-specific information, and is used to track the product’s advertising history in Merchant Center and Google Ads. If you change the ID, you’ll overwrite your product and its history.

The second major element of shopping campaign success is bidding. Pay too much for a click to gobble up your profits. Pay too little and your ad will fall short of the impressions or clicks required to get sales.

The goal is to apply the right bid to the right products at the right time. Segmentation of ad groups and product groups lets you apply the right bid to products. This is where you need to see what products get the impressions and clicks then appropriately segment your product groups so you can apply the right bids. Bid adjustments then let you apply the right bid for people at the right time.

A bid adjustment, also known as a bid modifier, lets you decrease or increase a bid based on where, when, and how people search. For example, if someone has abandoned cart on your website in the past thirty days, then they see a shopping ad of yours, would you want to pay more to get in the absolute top position for this person compared to a person who has never heard of your store? Of course yes! People who abandoned cart are far more likely to buy from you so you can afford to pay more for a click. Another example is for mobile versus desktop. If mobile users are 30% less likely to convert—and they often do—you are likely to want to pay 30% less for a mobile click.

The four major bid adjustments for shopping campaigns are devices, locations, ad schedule, and audience lists. We see beginners and “professional” ad agencies ignore bid adjustments all the time. I suspect most people get it wrong because they simply don’t know about these levers that can be pulled to optimise accounts. Later in this chapter you’ll learn how to make these work for you.

You now know that quality score and bidding affect shopping campaign performance. A helpful way to apply them to your campaigns is with the AIDA model.

The AIDA model of marketing is an acronym that stands for: Attention, Interest, Desire, Action.

The only way to improve the performance of your shopping ads or any digital advertising, is by increasing the attention, interest, desire, and action of people. Put aside everything you know about online marketing, then for a moment, reflect on the essence of AIDA. Any optimization we do seeks to tweak the levers in this model for growth.

If you can increase each of impressions, clicks, sales, and average order value by 20%, you will have increased revenue by 207% = 1.2 * 1.2 * 1.2 * 1.2 = 2.0736.

The simplest way to get more impressions is through higher bidding. You can see if bids limit impressions by looking at your impression share metric. From the columns in Google ads, select “Search impr. share” to see what campaigns, ad groups, and product groups are not 100%. Adjust the date period to see if bids in the past week are generating impressions.

If you are at 100% impression share, look at the absolute top impression share metric labelled “Search abs. top IS”. This metric is the percentage of impressions in the most prominent position on the page for shopping campaigns. In the example below, the Christmas tree priced at $289.50 would have its absolute top impression share metric of 100% if it always appeared in that first position.

You can guess that always being in the first position is unlikely to be the best formula for success. It is rarely desirable to achieve for most products because you must consider the ROAS. If return on ad spend goals are met for a campaign, ad group, or product group, continue to notch up bids until they hit your goals or 100% for the absolute top impression share.

The second way you can get more impressions is through better product titles, descriptions, and other feed optimisations already discussed in the chapter on setting up your feed. We’ll go through the most important elements of titles and descriptions here again because it is only once you run campaigns to gather data, can you truly optimise the keywords in them.

Click on your shopping campaign then go to “Keywords” and “Search Terms”. You will see the search queries that your shopping campaign has shown for. If you instead click on an ad group in the shopping campaign then view the search terms, you filter down the search terms for the ad group. Here you see the primary reason we divide our shopping campaign into ad groups: you can gather keyword data related to the products in the ad group.

With this keyword data, look at how the search terms fit with the products. Our primary intent here is to increase impressions. I have two helpful questions you can use to achieve this goal of optimising for impressions:

The third way to increase impressions is increasing your budget. It is a joy as a Google Ads specialist to go back to a business owner to tell them we are hitting our profit target, and that the budget is limiting growth. This applies if Google gives you a warning at the campaign level that your campaigns are being “Limited by budget”.

The last way to bolster impressions is with expansion. Channel expansion is covered in the last chapter, but as it relates directly to shopping ads, the most opportune ways are with locations, the partner network, and remarketing lists.

The methods to garner more clicks is similar to increasing impressions. Review the “Click share” metric from your columns under the “Competitive Metrics” section. Google says, “Everything you can do to increase impression share and absolute top impression share is also useful for increasing click share.”

If the campaigns do not have 100% absolute top impression share and you are hitting ROAS goals, increase bids to make the ads more prominent for extra clicks. The ROAS may remain stable—therefore adding revenue and profit due to the increased volume.

Below is a screenshot from one client’s campaign over the past week. ROAS is seen by multiplying the “Conv. value / cost” column by 100%. Their ROAS goal is 900%. The first ad group is bang on target at 892%. The second ad group falls short of the goal, but due to its ad spend and potential revenue per sale, a longer period needs to be looked at to see if it is profitable.

The absolute top impression share is more important on mobile devices compared to desktop because of the reduced visual space. When looking at impression share, click “Segments” then “Device” to see the difference between mobile, tablets, computers, and more recently TV screens.

If impression share is low on one device, but it has good return, you can use a device bid modifier to discriminate bids based on device type. By decreasing bids on mobile and increasing bids on computers, we can increase impressions and clicks on computers while lowering mobile to keep it profitable.

You can have a high impression share, but low click share because a product is below the number one position measured by the “absolute top impression share” metric. Google search the queries with high impression and low click share to see what the top products are doing that you are not. Chances are they are stealing a majority of clicks because their product is well-optimised or the query is a mobile-heavy search term.

Feed attributes that most affect clicks are titles, images, and price.

Improving clicks through titles is about making them appeal to users. Unlike a search ad where you can write nearly anything, product titles need to be keyword-rich and relevant to the product otherwise you will get low impressions or irrelevant clicks.

We’ve discussed a lot about titles already when you learned how to increase impressions. The same strategy of reviewing search terms for an ad group can be used to optimise titles. Are there high-impression keywords that can be front-loaded? Perhaps a product in the ad group already uses these keywords, but these popular keywords can be used at the start of the title.

If the product is made by an established brand, its brand is a good candidate for front-loading. Compare your titles to competitors in shopping ads for ideas. Use Amazon for another source of inspiration as Amazon sellers use keyword-rich titles. Review the chapter on setting up your feed in Shopify for best practices and ideas to optimise your titles for further clicks.

Images are first optimised by reviewing warnings or errors in Merchant Center. Once warnings and errors for images are solved, the next best way to optimise images is to look at them. Visit the URL of some image_link attributes to confirm what images are used. If you’ve mapped the first image of a product in Shopify to the image_link attribute, you can review the images in bulk by browsing the Shopify store like a customer to see how product images can improve. Review the do’s and don’ts of image_link for best practices of a good shopping ad image.

If you have a lot of products, get the loudest bang for your effort by reviewing the most important products. See what products get the highest impressions by going into the campaign, clicking on “Products”, then filter by impressions.

You can also view products with a high impression share and low click-through rate. Ensure the most popular products have good images.

Price monitoring matters most when the product you sell is available from another online store. People often go for the cheapest deal on Google Shopping when there is no difference in value-adds like delivery time, warranties, or shipping costs. After all, the platform has been described as a comparison shopping engine.

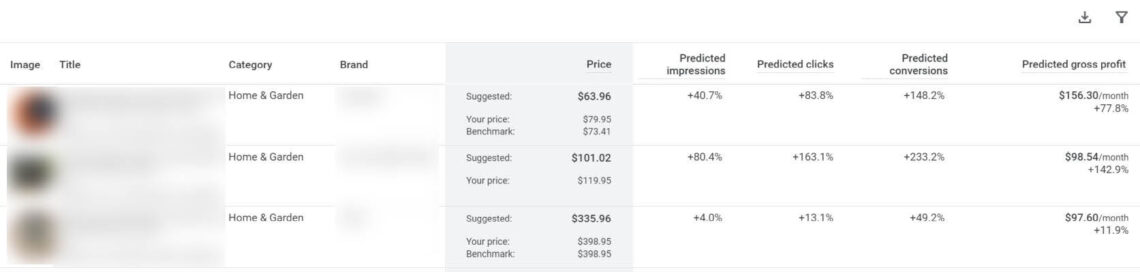

Google’s price insights report is the ultimate tool to monitor competitor prices in Google Shopping. Over the years there have been several tools like Pricing Lab’s price tracker to monitor competitor prices, but they’ve shut down since Google has their own tool. The report estimates the performance you can expect following the recommended price update.

If competitive pricing is critical for your business, you’ll want to check out setting up automated discounts. The program allows Google to help you discount product prices to save you time and improve performance from real-time signals. The setup lets you automatically apply this price on the website for shopping ads traffic. Since the program requires header modifications you can’t make yourself in theme, you can use a software partner to get set up.

You want to avoid price wars to maximise your margin. One strategy we’ve seen work well is meeting the lowest price rather than under-cutting. Couple it with optimising your delivery time, shipping costs, and reviews to set the store apart.

Some retailers must adhere to minimum advertising pricing (MAP) in their distribution agreement. If you see a competitor selling a product below the MAP, report them to your manufacturer or distributor. For more strategies with pricing products, see the pricing chapter in Shopify Conversion Rate Optimization.

The shopping experience scorecard monitors the experience customers have with shipping speed, shipping cost, return speed, and return window. You’re given a rating of “Excellent”, “Comparable”, or “Opportunity” on each metric.

One main benefit of optimising your Shopping experience scorecard is to get the verified “Trusted store” badge. The second benefit is your products could rank higher in the Shopping tab of search results. Each can increase your clicks and sales. Two stores in the following screenshot have earned the badge.

You can check performance for each metric and your overall score:

Google estimates a monthly increase of 100-200 clicks for the client seen above who has an excellent rating across all metrics.

There are two ways to optimise your Shopping experience scorecard. The first is to improve store policy and fulfilment. The second is to update the shipping and return information in Merchant Center so it is accurate. This can be done from the cog icon in Merchant Center then “Shipping and returns”.

There are two merchant programs that can increase interest and desire to boost clicks from shopping ads.

First is the Product Ratings program. Product Ratings provide a star-rating system inside the ad. They are a powerful trust signal when ratings are positive and can attract clicks. When ratings are negative, it can decrease clicks.

Merchant Promotions is another feature for Google Shopping offered through Merchant Center that can increase the clicks and sales through ads. It presents searchers a special offer in the form of a discount. The screenshot below shows a product using the merchant program to stand out.

Both types of merchant programs can attract attention to set your products apart from competitors. You’ll learn how to set up each Merchant Center program and best practices for each, in the next chapter.

We’ve looked at how you can get more attention, interest, and desire through shopping ads. Ads are not the be-all and end-all of profiting from Google Ads. One big step is left: all that happens in the store which is responsible for closing the sale. You will struggle to succeed in shopping if your products or store fails to build interest, desire, and action.

You’ve learned higher bids can get you more impressions. However, you cannot increase bids just to increase impression share if your return on ad spend is too high.

When you get more people to convert, you can bid more. When you bid more, you get more impressions. This is the cycle of how rapid growth happens in all Google campaigns.

I have completely covered the final step of getting more people to buy and buy more, in my Shopify Conversion Rate Optimization book. In it I teach you the ultimate ways to convert a higher number of visitors into sales and get increased revenue per sale. While every store can always be improving, if a store struggles to get one sale out of one hundred visitors, that is a red flag of a poor product or website.

The second most important element of your shopping feed after feed quality is bidding. When you overbid, you unnecessarily cut into profit margins. On the other end, not bidding enough stops your ads from reaching people.

Bidding on Google Shopping is a different ball game to search ads and having a few tricks up your sleeve will help you find that “sweet spot” between under or overbidding.

A campaign for products newly published in Merchant Center will struggle to get impressions. This is common as Google will throttle your ads in their first stage of life. Once data gathers, Google knows more about how people react to the ads based on the click-through rate relative to the position. Impressions then begin to gain momentum. If profitable, you know to increase bids to gain impressions and clicks until your ROAS drops below target.

The sweet spot to aim for with bidding is to hit your ROAS goal. You can pay cents for a click, yet fall short of the desired volume. You can pay boatloads of cash for a click, but there’s no point if you cannot turn it into revenue.

Bid management is like driving a car to a destination. You will constantly turn left and right. As long as you have your destination in mind, you can get there. By raising and lowering your bids over time, you can stay on target to make ads profitable.

Let’s say your goal is a 500% ROAS. There’s been $1000 in ad spend for 10 conversions with a total of $1000 in revenue. This gives a ROAS of 100%. For that to meet our target, ad spend needed to be $200. So given all things being equal over that period of time into the future, a bid drop of 500% would theoretically hit the sweet spot. If the 500% drop after a few weeks is too severe such that the ads are not getting any clicks, you’d want to raise the bid.

Here is another application of the sweet spot. Your goal is 400% for a high-ticket item priced at $1000. The sweet spot is $250 in ad spend for one sale of $1000. If you’ve spent anything less than $250, the volume of clicks falls short to assume it is under-performing.

Constant bid work is time-consuming. Consider an automated bid strategy to save time and even improve performance.

Once you understand the sweet spot from CPC-bidding, consider incorporating other bidding strategies into campaigns. Bidding is an ongoing challenge to get right, posing a risk, but it is an even bigger risk letting your ads run without bid adjustments as you waste ad spend, don’t get sales, or waste time unnecessarily tweaking bids up and down.

Bid strategies are split into manual and automated categories. Many Google Ads experts historically have taught to avoid an automated bid strategy, as you hand over control to Google’s artificial intelligence. Today though, automated strategies can save you a lot of time for better results. It is wise to trial a mixture of manual and automated bidding to work out what is best for performance.

Google’s bidding algorithms assess contextual signals at auction-time. These include the time of day, ad creative shown, and the user’s device, location, browser, language settings, operating system, and more. The end result is an automatic bid of more or less for a query to better reach your goals.

The less time you spend tinkering with bids, the more time is available to strategise, improve your feed, and do other tasks artificial intelligence cannot yet do.

One automated bid strategy discussed during the campaign setup is “maximise clicks”. The strategy pushes your ads to get the maximum number of clicks. Your budget becomes your bid. A business owner with half-a-brain will spend more on what’s making them money rather than focus on clicks, but early on in a campaign with unknown performance, this bid strategy can work until data comes in.

The automated bid strategy appealing for ecommerce is “target ROAS”. Google will automatically increase or decrease your bids every time your ad is eligible to run so it meets your defined ROAS.

Most campaigns for the first 90 days are best left to a manual bid strategy or maximising clicks. Then you can review the individual product performance data to see what products get clicks and conversion volume. You want to see as many products as possible spend past your CPA goal before swapping to a ROAS bid. If you introduce a ROAS bid too early, the only products that will deliver are ones that have converted on target. An early introduction of ROAS bidding hammers on a ceiling that stops scale.

The biggest challenge with ROAS bidding is fluctuations. Manual bids still fluctuate in performance so don’t let this deter you from the automated strategy. The more conversions you have, the more the bid strategy is able to keep bids in-line with ROAS:

| Number of Conversions (in the past 30 days) |

ROAS Fluctuation | Initial Learning Period |

|---|---|---|

| 50 | Medium to High | Slow |

| 100 | Medium | Medium |

| 200 | Low | Fast |

| 500 | Very Low | Very Fast |

Fluctuations happen more in the first week or two of a smart bidding strategy as Google goes through a “learning phase”. Changes to a campaign or an ad group will also prompt a new phase of learning. At the campaign level, when you click on “Target ROAS” in the “Bid Strategy Type” column, Google will display a “Learning (new strategy)” message and other useful information with more insight on its learning.

To help you understand the learning phase and implement a ROAS strategy well for your shopping campaign, Google in their smart-bidding playbook have six best practices:

The way I think about working with Google’s machine learning is letting it do the grind work with my oversight. Monitor the automation. Intelligent bid optimisation is a keystone of any successful Google Ads campaign. Without regular, data-driven bidding oversight, you run the risk of missing conversions and revenue.

Products can underdeliver inside a Performance Max or shopping campaign that uses a target ROAS bid. Google ends up judging certain products as being unable to meet the ROAS target, and so the AI doesn’t run them. While in reality, the products may convert fine upon receiving clicks.

A strategy I call “budget stepping” solves this problem to push spend behind products that don’t garner enough impressions:

In the event this still doesn’t work, give the no-click products a custom label. Create a campaign for these products that filter inventory by the custom label then use the maximize clicks bid strategy. This will force products eligible to run to get clicks.

During a sale, you’ll typically see an increase in your conversion rate and a drop in cost per conversion compared to your average period. This is a temporary peak so ramp up the exposure of ads by increasing bids for more traffic. If the store participates in Black Friday Cyber Monday, or runs any promotion that you anticipate will increase conversions, up the bids.

Google’s automated bid strategies prevent hyperactivity with sudden bid increases as adjustments are made on reliable performance data rather than temporary spikes. Even so, Google recommends advertisers who use automated bid strategies to adjust their bidding for the anticipated performance fluctuation.

The challenging question is knowing how much to increase the bids. You need to estimate bid adjustments off the data available to you. If you have a two-day sale then wait one day to make a bid adjustments, you have missed half of the sale. By making a performance-based hypothesis from data you can bid more aggressively to anticipate the improved conversions.

Look at past conversion rate changes and average order volume in Google Analytics during similar past sales. If the store ran a 20% off sale for one week three months ago, and is about to run another 20% off sale, see how this period compares to the before-and-after.

Implement the bid by creating a seasonality bid adjustment. The feature avoids harming the learning phase and lets you set a bid adjustment ahead of time to let Google know an anticipated change in conversion rates. A seasonality bid adjustment lets us aggressively launch sale campaigns for clients. Use it only for a period of under two weeks otherwise you are better off altering the bid within the campaign settings. Below you can see an example seasonality adjustment I did for a client who experiences a conversion decline of 25% over Christmas.

The average CPC goes up when there is a surge of competition in seasonal peaks. It is helpful to have a strategy to accommodate these peaks and dips throughout the year to meet your ROAS goal. For products with seasonal fluctuations, putting them in a separate campaign lets you prioritise then implement your bidding strategy at this time.

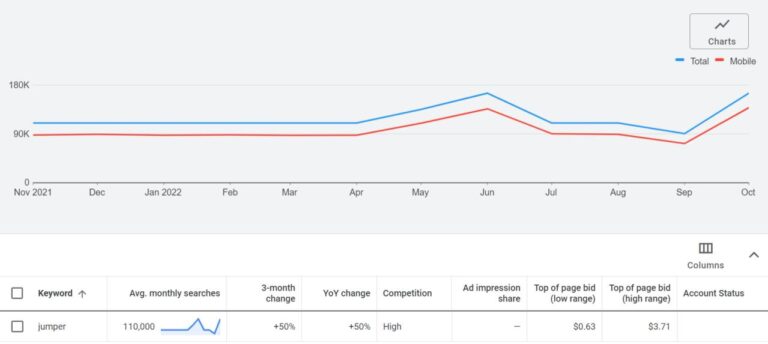

Chances are you have industry knowledge should your products be affected by seasonal fluctuations. Examples include back-to-school ranges, Christmas products, winter clothing, and Mother’s Day gifts. If you’re unsure about crests or troughs in traffic, peek at Google Trends. A comprehensive solution for Google Ads is to use the search volume and forecast option in the keyword planner tool.

A SKU-level bidding strategy is done by allocating unique bids for every product—splitting out your product groups and bidding at “SKU level”. It is a time-consuming way to bid in Google Shopping. How far you go is a balance of management time and control needed for performance.

Sometimes products in a product group perform differently to one another. Getting super-granular with your bids can be hard work, but it usually delivers the best results as you get clear data to make bid changes.

A good start for SKU-level bidding is looking at product groups generating 80% of the impressions, clicks, or revenue. Isolate the best and worst performing SKUs. These are good candidates to bid at the SKU level. This gives you greater control over the CPC and ROAS. So, if you notice one of your products is spending above its sweet spot, you can cut the bid. If it’s spending less than its sweet spot, you can increase the bid to reach more people.

A bid adjustment, or bid modifier, lets you adjust the price paid for someone’s click depending where, when, and how they search. There are four types of bid modifiers for Google Shopping ads: device, location, ad schedule, and audience. By understanding each one, you are more able to set the right bid to the right person at the right time.

As a general rule for all bid adjustments, you want to reach $200 in spend or 20 conversions for that device, location, time of day, or audience. Less than that often means the data set is too small for a statistical-driven optimisation. It’s also a good idea to consider the relative performance of other segments before you apply a bid modifier. A significant amount of data needs to be collected first to make an informed decision.

If you see people on computers have 10 conversions after $400 in spend, while mobile has had 2 conversions after $100 spend, yes mobile is doing worse then desktop, but there’s insignificant amounts of data. The next $100 in spend for mobile could get 6 conversions and by applying a bid modifier too early you hurt performance.

If people in Australia had $100 spend for 10 conversions while the United States had $100 spend for 0 conversions, while each falls short of the rule of thumb metrics, the performance difference is distinct. You could estimate a bid modifier to decrease bids on United States users.

You may be asking why I suggested decreasing bids on United States users rather than increasing bids on Australian users. Firstly, it depends on your ROAS goals. If Australian users were well above a target goal of 1 conversion for $20 in spend, you could increase the bids at the product group level or increase Australian bids with a bid adjustment. There are many ways to skin a cat. Personally I like to get the product group bid roughly to the average ROAS then apply bid modifiers. If you increase the product group bids, you’d want to proportionately decrease bids for United States users as you’d otherwise throw even more money at the poorer converting audience.

One final pointer I’ll make about working with bid adjustments is to constantly alternate the timelines you’re analysing. Look at the lifetime of the campaign then switch to the most recent 30 days. Perhaps the store was redesigned last month so that the last 30 days is a more reliable data source for bid adjustments. Or maybe you made changes to the campaign or feed that could improve performance for all segments.

Bid changes are not a one-off change. Revisit bid adjustments for devices, locations, time of day, and audiences to keep them optimised.

Now that you understand the logic behind working with bid adjustments, let’s dig into each adjustment to optimise shopping campaigns.

The device bid adjustment lets you adjust bids for people who see your ad on computers, tablets, and mobile phones. For new account builds, I like to log into Google Analytics, to see how computer, tablet, and mobile users already perform so we don’t have to throw unnecessary money on ads to find out. In Google Analytics 4, go to “Reports” > “Tech” > “Tech details”. Change the primary dimension to “Device category” and conversions to “purchases”.

In this screenshot we see desktop users have more purchases and far less sessions than mobile users. The conversion rate for desktop is 1,054 / 33,294 = 3.17%. For mobile, it is 1,008 / 54,318 = 2.04%.

So I’d want to apply a bid modifier to decrease mobile bids by 1 - (2.04 / 3.17) = 36%. You could also factor in average order value per device as it can differ, but a pre-emptive modifier is good enough for now. Google Ads performance may differ to your other channels so you don’t have to get it perfect.

It’s rare to see computers, tablets, and mobile perform equal to each other. While mobile can convert better than computers, I typically see mobile convert 30% less than computers with tablet in between at 15% less than computers.

To review device performance for a Google Ads campaign, click on the campaign then “Devices” from the left-side. Adjust the timeline from long to short and in-between to get an accurate picture of what bid modifier you can apply.

If you’re using an automated bid strategy like maximize clicks or target ROAS, you cannot set a bid modifier other than -100% to exclude that device, which I never recommend.

Advertisers lose thousands of dollars by either showing their Google ads in the wrong location or paying the same price for everyone in each country. The mistake exists at the state and city region as well. Swimwear may convert twice as well in Florida compared to Nebraska so discriminate your manual bids.

The first tip for location optimisation is an obvious one: target the regions you serve. If the store only delivers to England, don’t show ads in Germany. People will leave the site when they realise products cannot be shipped to them. Review the locations for each campaign to ensure you ship to areas being advertised.

My second tip and one of the easiest ways to scale an ad account is to target all the locations the store ships to. If you want to target more countries through shopping ads, add the country to your feed in Merchant Center.

My third and last tip is to set granular locations for the campaigns. Few ad agencies or account managers do this. Add states, even cities or at least your most popular ones, to campaigns.

Granular locations are where bid modifiers excel for locations. If you set the location only to the United States, you’d still target the same people as if you added individual states, but adding states, cities, postcodes, or even radius areas lets you tinker bids so each region hits the ROAS goal. The end outcome is you reduce wasted money on poor-performing regions while growing regions that perform well.

As for location exclusions, you can exclude areas you don’t serve (like a state) that are within your targeted locations (like a country). It is unnecessary to exclude all areas you don’t deliver to if the targeting settings do not include them.

A second way to use exclusions for locations is if you find search queries that contain country names you don’t sell to. That way if your campaign location settings is set to exclude “People in, or who show interest in, your excluded locations”, you won’t target these people in one country looking to buy in another country.

People convert differently depending on the time of day or the day of the week. Your Google Shopping campaign could reach your ROAS target, but you may lose money on the weekends and from 12am to 4am on weekdays. We want the campaigns to perform the best they can at any hour or day. Smart bid strategies, or a Performance Max campaign, take away the option of control.

You can see how a campaign performs for the day or hour by clicking on the campaign then on “Ad schedule” at the left side of the page. Look for tabs at the top of the page that say, “Day & Hour”, “Day” and “Hour”. Choose what metrics you want to look at. I suggest looking at clicks, cost-per-click (CPC), total conversion value, and conversion rate.

A more comprehensive alternative is to use the hour-by-hour trends script created by Brain Labs. The script pulls data from the account to create a heat map showing metrics on a daily or hourly basis. Couple it with the 24-hour bidding script to optimise bids every hour of the day. Here’s an example of the hour-by-hour report for a client that shows how conversions plummet during the night.

As an ecommerce store, you are open 24 hours, 7 days a week so you never want to exclude a time of day. Most advertisers will not have the conversion volume or ad spend to deduce insights for the ad schedule since you need a large data set for each hour of the day to see correlation.

There are several types of audiences available to optimise ad campaigns. Use all types to help your campaigns grow.

A remarketing list can be applied to your Google Shopping campaign, which is a way to show ads to people who have previously been on your site.

Remember the audiences in Analytics we set up in chapter four? Apply these audiences to your campaigns in observation mode. Click on the campaign, then “Audiences” on the left-side. Select the remarketing audiences to add and ensure “Observation” mode is selected. This way your ads will still show to people who have not visited your store and you can pay more to appear in a higher ad position for people who have visited.

The methodology for applying bid modifiers pre-emptively, rather than off actual data, to remarketing lists is this:

If you already have good data to adjust bids for your remarketing lists, use that to make your decision on bid adjustments. If you’ve just added the audiences, the absolute amount is unclear, but you know you can pay more for someone who visited the store 7 days ago compared to 30 days ago. Likewise, you can pay more for someone who made it to checkout compared to someone who didn’t make it past a product page.

You can upload your list of newsletter subscribers or Shopify customers into Google Ads then target these people. From there, you can bid aggressively on the audience for shopping ads or run remarketing ads to them when they are logged into their Google, YouTube, or Gmail account. The tool lets you reacquire customers online who’s emails you collected offline in your retail store.

The feature is great to train Google’s machine learning about what your customers look like so the AI can acquire more of them. From “Settings” on the left, click “Account settings”. Click “Customer Match” and enable “Use all Customer Match lists in Smart Bidding or optimised targeting”.

The requirement for customer match is stringent for retailers. Previously you needed 1000 email profiles then you were able to use the platform. Now you need the equivalent spend of USD 50,000 in Google Ads, a good payment history, and at least 90 days of running Google Ads. It goes without saying, Google has strict policy requirements that you must adhere to ensure you have permission to use people’s details for marketing.

To create a customer match list from Shopify, the easiest method is to use the Klaviyo integration. Sync your customer list to Google Ads. If you’re not on Klaviyo, here’s how to do it from Shopify:

Prepare and upload the CSV file:

You can use the customer match audience for search ads, remarketing ads, Gmail ads, Performance Max, and dynamic prospecting on the display network. To use this audience in Google Shopping, add the audience list as you would any other audience. Apply a generous bid modifier on it as customers convert well.

You may find yourself advertising the same products at the same time, in the same places, but in different campaigns. Or perhaps you’d like to push a product harder for some search terms by bidding more because they convert better compared to other search terms. Both of these scenarios can be handled with campaign priorities.

The “Campaign priority” setting tells Google what campaign to run first for its eligible search terms. Google says it is useful only when the same product is in multiple campaigns. That is the most important thing to keep in mind about prioritisation. The setting has three options of either high, medium, or low. When you first create a campaign, the default priority setting is low. A higher priority campaign is the first to show.

In instances where the campaign cannot be triggered, such as being outside the scheduled running time or when the budget runs out, the next highest priority campaign will run. When you have the same priority over multiple campaigns with the same product in it, the highest bidding campaign is Google’s next priority.

The King and Peasant Strategy lets you use campaign priorities and negative keywords to pay more for some search terms than others. I will show you how to use campaign prioritisation to grow profit from shopping ads. By understanding negative keywords first, you’ll get a clear picture of how priorities fit into paying more for profitable searches in shopping ads.

Negative keywords are terms you don’t want ads to show for. For example, if you sell high-end, white wedding dresses, you will want to avoid ads showing for terms such as “cheap”, “second hand”, and “blue” by adding them as negative keywords.

If you’re familiar with search campaigns, you know about keyword match types. Google Shopping uses match types for negative keywords the same way. This is a breakdown of how the three match types are used:

Google notes that for all match types, your ad may still show for variations of your negative keyword term. That is why it’s a good idea to revisit your search terms report to see what search terms come through for your campaigns.

You can add negative keywords at both the campaign and ad group level. This can help products show for the most relevant searches. For example, if you’re a clothing retailer with a campaign for men’s Nike socks and each ad group is split out by colour, you may want to add the inaccurate colours relative to each ad group as negatives. This may boost CTR and conversions. However, at Digital Darts we find a feed with accurate data stops us needing to do extensive keyword-shaping of ad groups.

The King and Peasant strategy lets you treat valuable keywords that drive profit differently to the majority. Similar to there being a hierarchy of Kings, Nobleman, and Peasants in medieval days that determined military and legal rights, search terms in your shopping ads should have a different hierarchy to determine what products show for what keywords at what price per click.

The first step of the strategy is to determine your Kings. These are the keywords you want to bid higher on. You should base this decision off data since many keywords will appear to be Kings but lack true wealth. Search queries with clear commercial intent usually convert better, but I’ve seen weird queries convert better than ones with commercial intent. The keywords I typically see across industries that do better than the campaign average include:

The manual way to find what keywords convert well is to filter the search terms report by your chosen keyword. You will get a summary of query performance. This is time-consuming and you may miss good-performing keywords.

Once you’ve got more than 1,000 conversions, the better way is to use the n-gram analysis script to see the clusters of keywords that have converted well. The script is recommended below in the tools section of this chapter. I include search ads in the n-gram analysis because the queries carry similar intent for shopping ads. When running the script, you can test including only shopping ads.

If the store is new to shopping or you don’t have data to make a hypothesis about what search queries convert, I recommend you use the priority structure if you have brands or models people search for, or products that convert like hotcakes. It’s a safe bet that search queries or these products will convert better. With that said, we have client accounts where brands do not convert better than general search terms, though I’ve not seen such queries do worse.

When you’ve decided on the keywords that convert better than the average, these can go into a negative keyword list.

With this strategy for the same products across campaigns, you will see the “search terms” report for the lower setting campaign only contains negative keywords in the higher priority campaign. That is how you do the King and Peasant Strategy to discriminate bids for Google Shopping.

While on the topic of negative keywords, it’s worth discussing how they can be used for campaign optimization. One major contributor to unnecessary ad costs is showing ads for irrelevant searches. When a user clicks an irrelevant ad, they quickly realise it’s not the right website or product for them, leaving you with the cost for the click but no sale. How do you manage this?

Your first port of call is your search terms report. This report should be reviewed on a weekly basis to reduce wasted ad spend. To access this, go to your campaign, click “keywords” on the left, and then click the tab at the top called “search terms”. This opens the list of search terms your shopping ads triggered for within the selected time-frame.

With the data in front of you, you are now able to make optimisation decisions such as:

If a store does Google Ads and we run their SEO, we love to use the search terms report to fuel the SEO keyword strategy. You will get accurate data of search volume and what terms bring in profit, more than any keyword tool. Businesses will spend years blindly chasing organic rankings for keywords not knowing a Google Ads campaign can lead their SEO strategy.

So far in this chapter we’ve covered the tactics to optimise campaigns. There’s a lot to do. It helps to consider ways you can save time. Tools are one way to help with campaign optimisations. The right tool will save you time while others enable you to do things you otherwise couldn’t do.

Three categories of tools we at Digital Darts find valuable to grow Google Shopping campaigns help us to:

Every advertiser should know what is happening outside their Google Ads account in real search results. It is easy to stay in the Google Ads account, but venturing outside to understand how customers see your products and potentially perceive them among competition helps you with ways to optimise your account. There are three tools anyone can use to sniff out the competition.

I often find the best way to get an understanding of competition in the battleground is the old “Googling keywords in your product titles” method. Take note of the results that come up, the products themselves, how the product title has been written, what the image looks like, and the price. How can you improve your products from this data? Is their photography clearer? Does their title have an important keyword you overlooked? Does the coupon they’re offering in the ad through Merchant Promotions seem irresistible?

Also look at how many retailers are offering the same, or relatively similar, products to you. Is there a lot of competition? Where there are few or none, it could mean your competitors are not optimising their feed or campaign? Or maybe there’s just no competition and lots of opportunity for you to take centre stage.

With your new found knowledge of Google Shopping, when you look at search results as an everyday shopper, you may get new ideas to test. Sometimes looking at search results will make an non-optimal feed configuration so obvious you’ll slap yourself for missing it. Perhaps you’ll realise you can make better use of Merchant Promotions. Maybe your pricing for a product is too high. It is possible you’ve never searched on a foreign Google domain before that you’re advertising on, but doing so changes how you think shopping ads display.

The disadvantage of manual competitor analysis is the time it takes. Even so, you should still do it as a research method in your bag of tricks.

The Auction insights tool within the Google Ads interface shows how competitors perform in comparison to you. It is available for search ads as well as shopping ads. For Google Shopping, you are able to compare impression share, overlap rate, and outranking share. The downside of Google’s Auction insights is that the search queries are hidden.

SEMRush helps you do all of the above and more. It identifies competitors for your keywords and tells you what keywords your competitors show for. It estimates the approximate spend compared to search ads. You can see other statistics like the position where the shopping ads showed and their title and price. You may be able to discover popular products of competitors. This can make your research more comprehensive and effective. It is a paid service given the amount of data available. If you are unsure of its value but curious, sign up for a free trial to test it.

These tools enable you to do things you otherwise couldn’t do, save you time, and help you get the most out of your Google Ads.

Without a doubt, DataFeedWatch is our favourite tool for Google Shopping and Performance Max campaigns. The feed management tool was discussed in the chapter on feed creation and optimization. DataFeedWatch keeps getting better every month.

Two cool features which affect optimization is the ability to split-test titles and use metrics from Google Analytics to shape campaign structure. Use the Google Analytics add-on in sheets to import analytics data. You can then use the DataFeedWatch lookup function to add custom labels based on any analytics metric.

Account managers will find Optmyzr helpful for automation across the board. We use it at Digital Darts to save time on tasks. The “root cause change analysis” provides insightful suggestions as to fluctuations in performance. Using Optmyzr’s negative keyword finder can help you come up with negative keywords as well as identifying terms you may not have thought of.

Google Ads scripts automate actions for you. A script can make adjustments for you at the frequency you want without getting you to even log into Google Ads. Scripts can save you from manual work by exporting then formatting data in Google sheets. Each script typically has instructions to use it so marketers don’t have to call upon a programmer. I have three favourite scripts to support Google Shopping campaigns.

This script provides a visualisation of competition and further segments the Auction insights report. The auction insights script is filled with information such as your average position, impression share (how many times your ads showed for terms that match the search term), and your top-of-page rate. Most importantly, it shows how this compares to everyone else in the market who show up for the same terms.

While it’s important to not get stuck in too much data—getting consumed by competitor analysis with no insights to action—it’s encouraging to have an idea of how you perform within the market.

The script helps you not only see where you sit among the competition but it also visually breaks the data down over time. This is essential to see how major changes by you or competitors impact results. The script also lets you filter data so you can choose individual competitors to monitor.

My favourite Google Ads script of all time for many years. The n-gram analysis script identifies keyword groups that have lost money or gained a profit. N-grams are search terms with the N referring to the amount of words in a query. For example, a 1-gram is one word, a 2-gram is two words in the search query, and so on.

The script produces a sheet of data for all N-grams including cost, clicks, conversions, revenue, and return on ad spend. You define what campaigns to analyse, over how long a period of time, and how big or small the phrases must be.

Use this report to come up with shopping campaign prioritisation using negative keywords so you bid higher on your most profitable searches. Outside of shopping, the script is pure gold to plan the structure of ad groups for search campaigns. For bad N-grams, you can add them to a negative keyword list to reduce ad waste. The N-gram analysis script shines brightest when there are millions of clicks and tens of thousands of conversions.

Tired of having to log into Google Merchant Center to see the approval status of your products? The GMC Disapproval Checker will send you emails if the percentage of disapproved products exceed your defined threshold.

The script is best run on a schedule as a warning system. By default it will check every product in the account, but you can include or exclude products by their ID. This means you can run multiple versions of the script like one for business as usual products and another for promotions.

Part 7: Performance Max CampaignsPart 9: Google Merchant Center Programs